Call Backspread overview

Call backspreads have three components: one short call option sold in-the-money below the current stock price and two out-of-the-money long call options purchased at a higher price. The long calls will have the same strike price. All three call options have the same expiration date. Call backspreads may be opened for a debit or a credit, depending on the options contacts’ pricing. However, call backspreads are typically established for a credit. The strategy looks to take advantage of a significant move up in the underlying stock and, if the position is opened for a credit, also has profit potential if the security moves lower.

Call Backspread market outlook

A call backspread is purchased when an investor is bullish and believes the underlying asset’s price will be above the long call strike prices at expiration. The profit potential is unlimited above the long calls. A slight increase in price is the worst scenario for a call backspread. The risk is limited if the underlying stock price decreases significantly. If the call backspread is opened for a credit, the position will profit from a decrease in price.

How to set up a Call Backspread

A call backspread consists of selling-to-open (STO) one short call option in-the-money and buying-to-open (BTO) two long calls out-of-the-money above the short call option. The number of contracts must have a ratio where more long calls are purchased than short calls are sold.

For example, 1 short call option would require 2 long call options. If the position is opened for a credit, the maximum loss is realized if the underlying stock price is at the strike price of the long call option at expiration, because the short call would be in-the-money and the long calls would expire worthless. The profit potential is unlimited beyond the long call options.

The debit paid or credit collected at entry will depend on how far in-the-money the short call option is and how far out-of-the-money the long call options are relative to the underlying stock price.

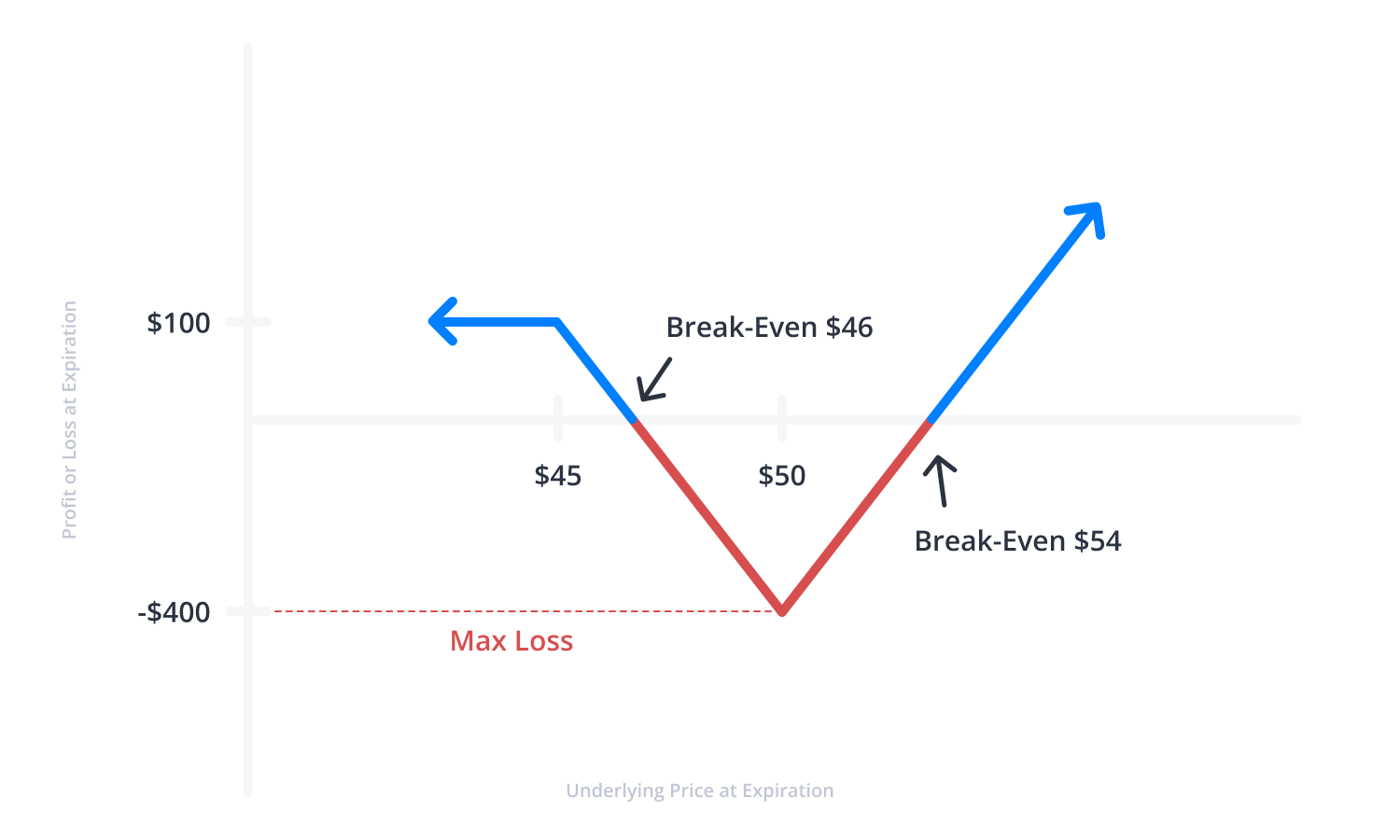

Call Backspread payoff diagram

The payoff diagram for a call backspread opened for a credit is V-shaped, with the left side of the “V” capped at the amount of credit received. The risk is defined at entry, while the profit potential is unlimited to the upside. The maximum loss is the width of the spread minus the credit received at entry. The max loss is realized if the underlying stock closes right at the strike price of the long call options at expiration. In this scenario, the short call would finish in-the-money, and the long calls would have no intrinsic value.

If the stock price closes below the short call at expiration, all options will expire worthless, and the credit received at entry would be realized as a profit. If the stock price closes above the long calls at expiration, all options would expire in-the-money and need to be closed to avoid exercise and assignment. The intrinsic value of the remaining long call option would remain. The width of the spread between the bear call spread, plus or minus the entry pricing, would equal the net profit.

For example, if a stock is trading at $48, and an investor believes the stock will close above $50 at expiration, a call backspread may be entered by selling-to-open (STO) one $45 call option and buying-to-open (BTO) two $50 call options. If the $45 call option received $5.00 in credit, and the two $50 call options cost $2.00 each, the position would create a $1.00 credit at entry. If the stock is at or below $45 at expiration, all of the calls expire worthless and the $100 initial credit received is realized as a profit. If the underlying stock price is $50 at expiration, the long $50 strike calls would expire worthless, and the short call will cost $5.00 to close. The $5.00 to close, minus the $1.00 initial credit, results in the maximum loss for the position of -$400.

If the stock is above $50 at expiration, the realized profit or loss would be the difference between the stock price and the long call price, multiplied by the number of long call contracts, plus the initial credit received, minus the intrinsic value of the in-the-money short call option. For example, if the stock closed at $52 at expiration, the net loss would be -$200. The short call would be in-the-money $7.00 and the two long calls would be in-the-money $2.00. The long calls would profit $400 ($2.00 ITM x2) + the initial credit of $100 = +$500. But, the short call would need to be closed for -$700.

There are two break-even prices for a call backspread: 1) the strike price of the short call plus the credit received and 2) the strike price of the short call plus two times the difference between the strike prices minus the initial credit. In the example above, the two break-even prices are $46 and $54. If the underlying stock is above the upper break-even price, the profit is unlimited to the upside.

Entering a Call Backspread

A call backspread is a bear call credit spread with an additional call purchased at the same strike price as the long call in the spread. All options have the same expiration date.

To enter the position, sell-to-open (STO) a short call option and buy-to-open (BTO) long call options. The ratio of long calls to short calls must be greater than 1:1. Despite the bear call spread, the strategy is bullish. The call backspread has a similar payoff diagram and outlook as a single long call, but with an additional opportunity for profit on the downside when sold for a credit. The bear call spread reduces the price of the additional long call option and decreases the potential risk by bringing in a credit.

Call backspreads may be purchased for a debit or sold for a credit. The price at entry will depend on the width of the spread, how far in-the-money the short call option is, and how far out-of-the-money the long call options are relative to the underlying’s stock price.

Exiting a Call Backspread

A call backspread needs significant movement above the long call strike prices for maximum profit potential. If the underlying stock price is above the long calls at expiration, all three options are in-the-money and must be exited to avoid exercise and assignment. If the stock price is above the short call at expiration, the contract is in-the-money and needs to be closed to avoid assignment.

Profit or loss will depend on the pricing at entry. If the stock price is below the short call option, all contracts will expire worthless, and no action is needed. The credit to enter the position will remain.

Time decay impact on a Call Backspread

Call backspreads are a net long position. Therefore, time decay, or theta, works against the strategy. Every day the time value of an options contract decreases, which will hurt the value of the two long call options.

Implied volatility impact on a Call Backspread

Call backspreads benefit from an increase in the value of implied volatility. Higher implied volatility results in higher option premium prices. Ideally, when a call backspread is opened, implied volatility is lower than where it is at exit or expiration. The strategy relies on the value of the long options to be profitable. Future volatility, or vega, is uncertain and unpredictable. Still, it is good to know how volatility will affect the pricing of the options contracts.

Adjusting a Call Backspread

Call backspreads have a finite amount of time to be profitable. If the call backspread is sold for a credit at entry, and risk is limited by the structure of the position, call backspreads are typically not adjusted. The position may be rolled up or down if the stock price is not in the profit zone. Call backspreads include at least one short contract. Therefore, assignment is a risk any time before expiration.

External factors, such as dividends, may need to be considered when deciding to adjust or close a call backspread position. If an investor wants to avoid assignment risk, or needs to extend the trade into the future to allow the strategy more time to become profitable, the entire position can be closed and reopened at a future expiration date with the same strike prices or new positions.

Rolling a Call Backspread

Call backspreads require the underlying stock price to be above a specific price at expiration. If the position is not profitable and an investor wishes to extend the trade's length, the spread may be closed and reopened for a future expiration date. Because more time equates to higher options prices, the rollout may cost money and add risk to the position. The strike prices of the options in a call backspread may also be rolled up or down to reflect any change in price from the underlying asset.

Hedging a Call Backspread

It may be unnecessary to hedge call backspreads because the strategy is a risk-defined position with a clear payoff diagram. The strategy is bullish, and protection from lower movement in the underlying stock is not needed because the bear call spread defines the risk to the downside and a sharp decline in the underlying security will result in a profit equal to the amount of credit received at entry.

FAQs

What is a call backspread options strategy?

A call backspread is a multi-leg, risk-defined, bullish strategy, with unlimited profit potential. The strategy looks to take advantage of a significant move up in the underlying stock while limiting downside risk. A call backspread consists of selling-to-open (STO) one short call option in-the-money and buying-to-open (BTO) two long calls above the short call option and out-of-the-money. The number of contracts must have a ratio where more long calls are purchased than short calls are sold. A call backspread is purchased when an investor is bullish and believes the underlying asset’s price will be above the long call strike prices at expiration. The profit potential is unlimited above the long calls.

What is an example of a call ratio backspread?

If a stock is trading at $48, and you believe the stock will be above $50 at expiration, you can enter a call backspread by selling-to-open (STO) one $45 call option and buying-to-open (BTO) two $50 call options. If the $45 call option received $5.00 in credit, and the two $50 call options cost $2.00 each, the position would create a $1.00 credit at entry. If the stock is at or below $45 at expiration, all of the calls expire worthless and the $100 initial credit received is realized as a profit. If the underlying stock price is $50 at expiration, the long $50 strike calls would expire worthless, and the short call will cost $5.00 to close. The $5.00 to close, minus the $1.00 initial credit, results in the maximum loss for the position of -$400. If the stock is above $50 at expiration, the realized profit or loss would be the difference between the stock price and the long call price, multiplied by the number of long call contracts, plus the initial credit received, minus the intrinsic value of the in-the-money short call option. For example, if the stock closed at $52 at expiration, the net loss would be -$200. The short call would be in-the-money $7.00 and the two long calls would be in-the-money $2.00. The long calls would profit $400 ($2.00 ITM x2) + the initial credit of $100 = +$500. But, the short call would need to be closed for -$700.

What is the call ratio backspread max loss?

The maximum loss for a call ratio backspread is the width of the spread minus the credit received at entry. The max loss is realized if the underlying stock closes right at the strike price of the long call options at expiration. In this scenario, the short call would finish in-the-money, and the long calls would have no intrinsic value.