Long Call overview

Long call options give the buyer the right, but no obligation, to purchase shares of the underlying asset at the strike price on or before expiration. Because options are levered investments, each contract is equivalent to holding 100 shares of stock. An advantage of using a long call option is that less capital is required to own one contract compared to the cost of owning 100 shares of stock, and downside risk is limited to the option contract’s cost.

Long Call market outlook

A long call is purchased when the buyer believes the price of the underlying asset will increase by at least the cost of the premium on or before the expiration date. Further out-of-the-money strike prices will be less expensive but have a lower probability of success. The further out-of-the-money the strike price, the more bullish the sentiment for the outlook of the underlying asset.

How to set up a Long Call

A long call position is initiated when a buyer purchases a call option contract. Calls are listed in an option chain and provide relevant information for every strike price and expiration available, including the bid-ask price. The cost to enter the trade is called the premium. Market participants consider multiple factors to assess the value of an option’s premium, including the strike price relative to the stock price, time until expiration, and volatility.

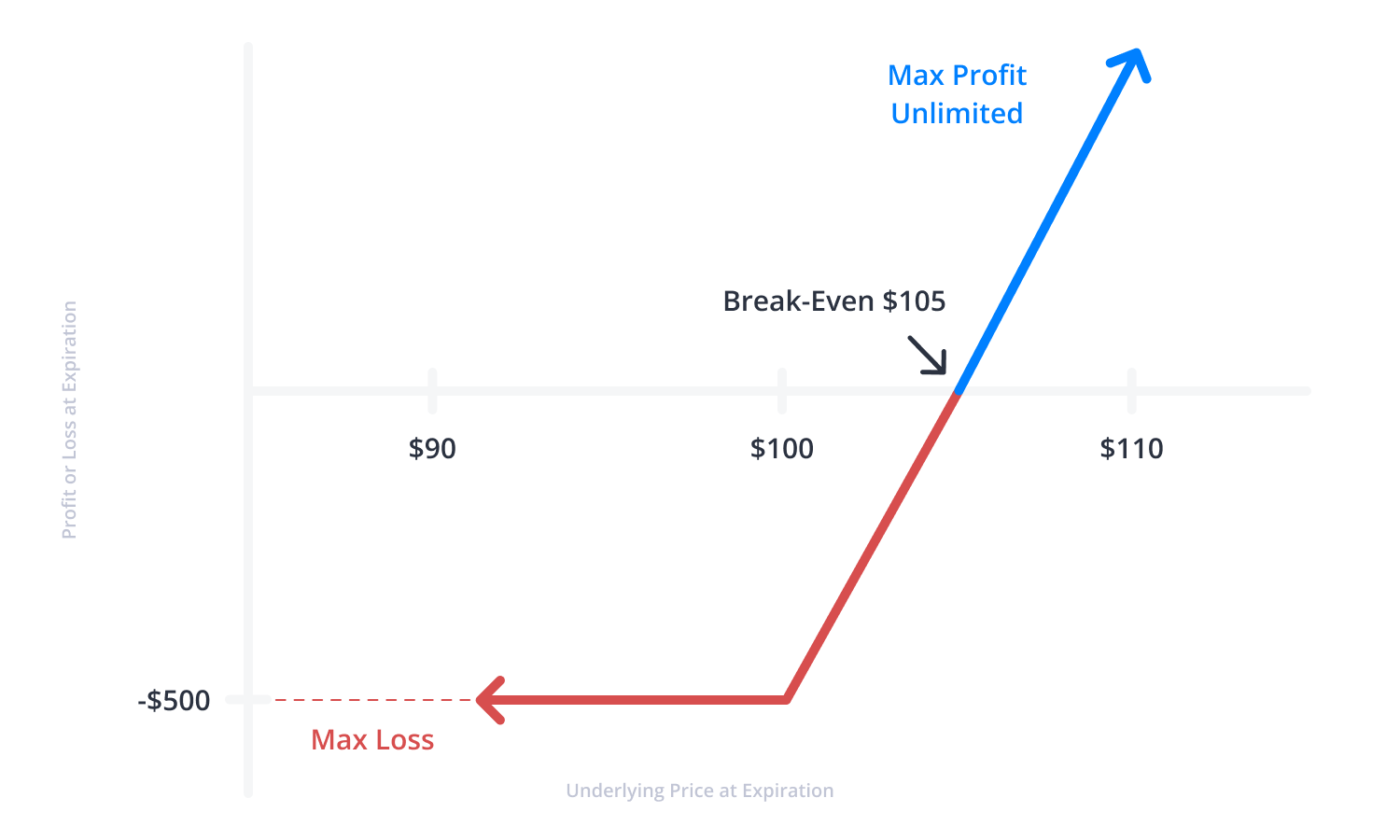

Long Call payoff diagram

The payoff diagram for a long call is straightforward. The maximum risk is limited to the cost of the option. The profit potential is unlimited. To break even on the trade at expiration, the stock price must exceed the strike price by the cost of the long call option.

For example, if a long call option with a $100 strike price is purchased for $5.00, the maximum loss is defined at $500 and the profit potential is unlimited if the stock continues to rise. However, the underlying stock must be above $105 at expiration to realize a profit.

Entering a Long Call

To enter a long call position, a buy-to-open (BTO) order is sent to the broker. The order is either filled at the asking price (market order) or at a specific price an investor is willing to pay (limit order). The call option purchase results in cash debited from the trading account.

-

Buy-to-open: $100 call

Exiting a Long Call

There are multiple ways to exit a long call position. Anytime before expiration, a sell-to-close (STC) order can be entered, and the contract will be sold at the market or a limit price. The premium collected will be credited to the account.

If the contract is sold for more premium than originally paid, a profit is realized. If the contract is sold for less premium than originally paid, a loss is realized.

If the long call option is in-the-money (ITM) at expiration, the holder of the contract can choose to exercise the option and will receive 100 shares of stock at the strike price. If the long call option is out-of-the-money (OTM) at expiration, the contract will expire worthless and the full loss is realized.

Time decay impact on a Long Call

Time remaining until expiration and implied volatility make up an option’s extrinsic value and impact the premium price. All else being equal, options contracts with more time until expiration will have higher prices because there is more time for the underlying asset to experience price movement. As time until expiration decreases, the option price goes down. Therefore, time decay, or theta, works against options buyers.

Implied volatility impact on a Long Call

Implied volatility reflects the possibility of future price movements. Higher implied volatility results in higher priced options because there is an expectation the price may move more than expected in the future. As implied volatility decreases, the option price goes down. Options buyers benefit when implied volatility increases before expiration.

Adjusting a Long Call

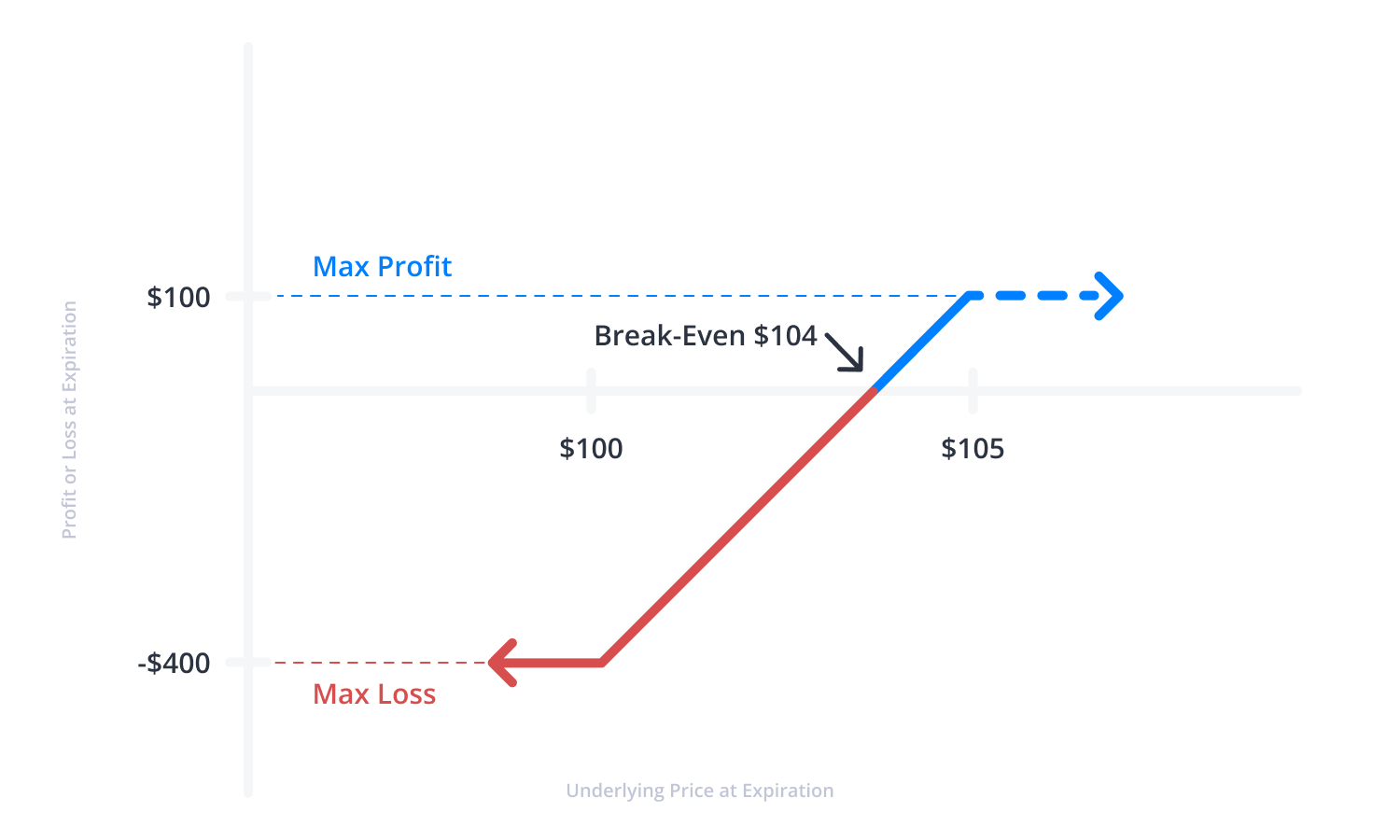

Long call positions can be managed during a trade to minimize loss. A single-leg long call option can converted into a bull call debit spread.

If the stock price declines, a call option can be sold at a higher strike price to reduce the trade's risk. This decreases the overall cost of the original position and lowers the break-even price. However, the short call option limits the maximum profit potential to the spread width minus the debit paid.

For example, if a $100 call option was purchased for $5.00, a $105 call option could be sold. If the short call option collects $1.00 of credit, the maximum loss is reduced to -$400. The max profit, however, is now capped at $100 if the stock reverses and closes above $105 at expiration. The break-even point is now $1.00 less than the original payoff diagram.

-

Sell-to-open: $105 call

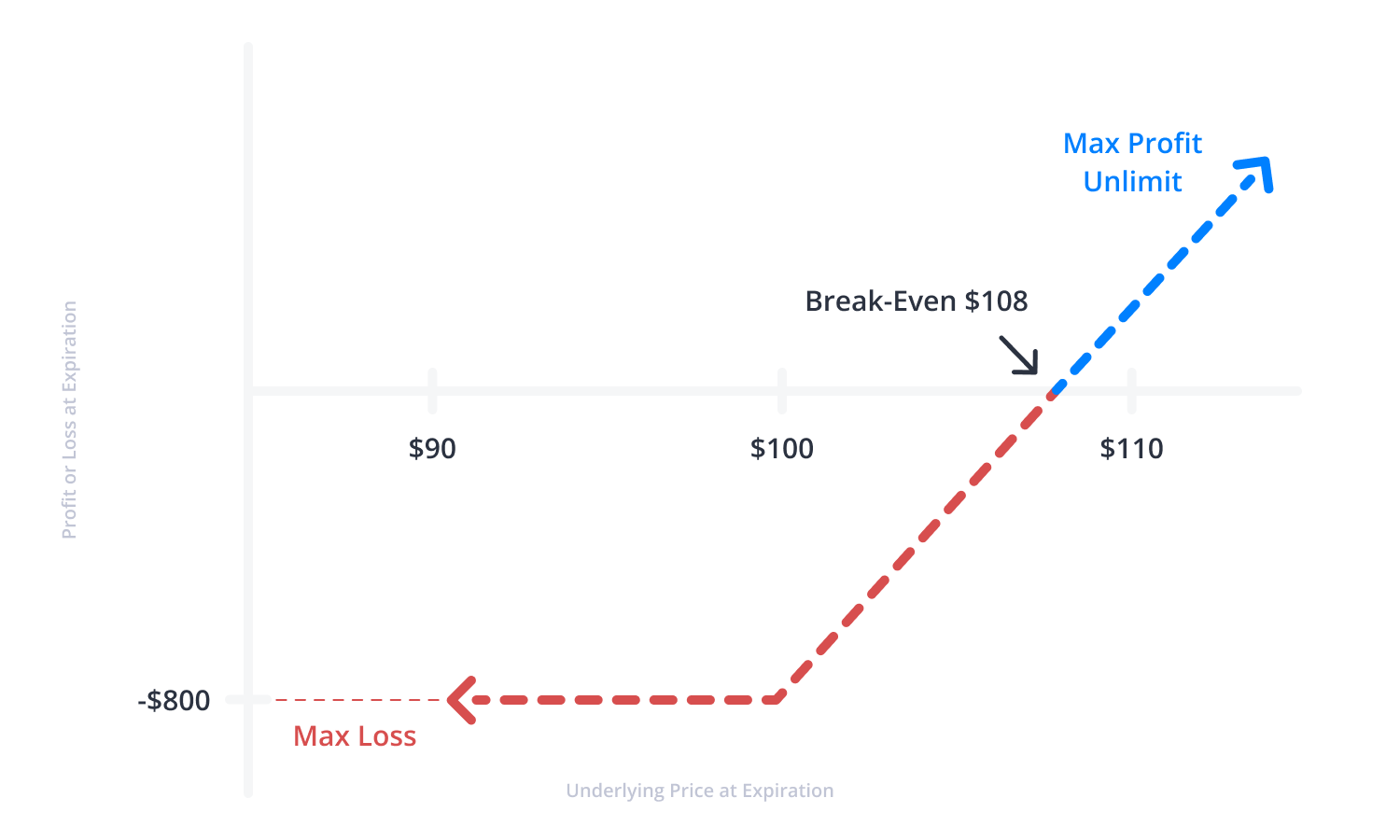

Rolling a Long Call

Long call positions can be adjusted to extend the time duration of the trade if the stock has not increased before expiration. The ability to roll the position into the future allows the trade more time to become profitable, but will come at a cost because more time equates to higher options prices.

For example, a $100 call option with a November expiration date could be sold and a $100 call option could be purchased for December. If the original position cost $5.00, and was sold for $2.00, the net loss on the original position is -$300 per contract. If the December option costs an additional $5.00, the overall debit of the position is now $8.00. Therefore, the max loss increases to -$800 and the break-even point moves out to $108.

For example, a $100 call option with a November expiration date could be sold and a $100 call option could be purchased for December. If the original position cost $5.00, and was sold for $2.00, the net loss on the original position is -$300 per contract. If the December option costs an additional $5.00, the overall debit of the position is now $8.00. Therefore, the max loss increases to -$800 and the break-even point moves out to $108.

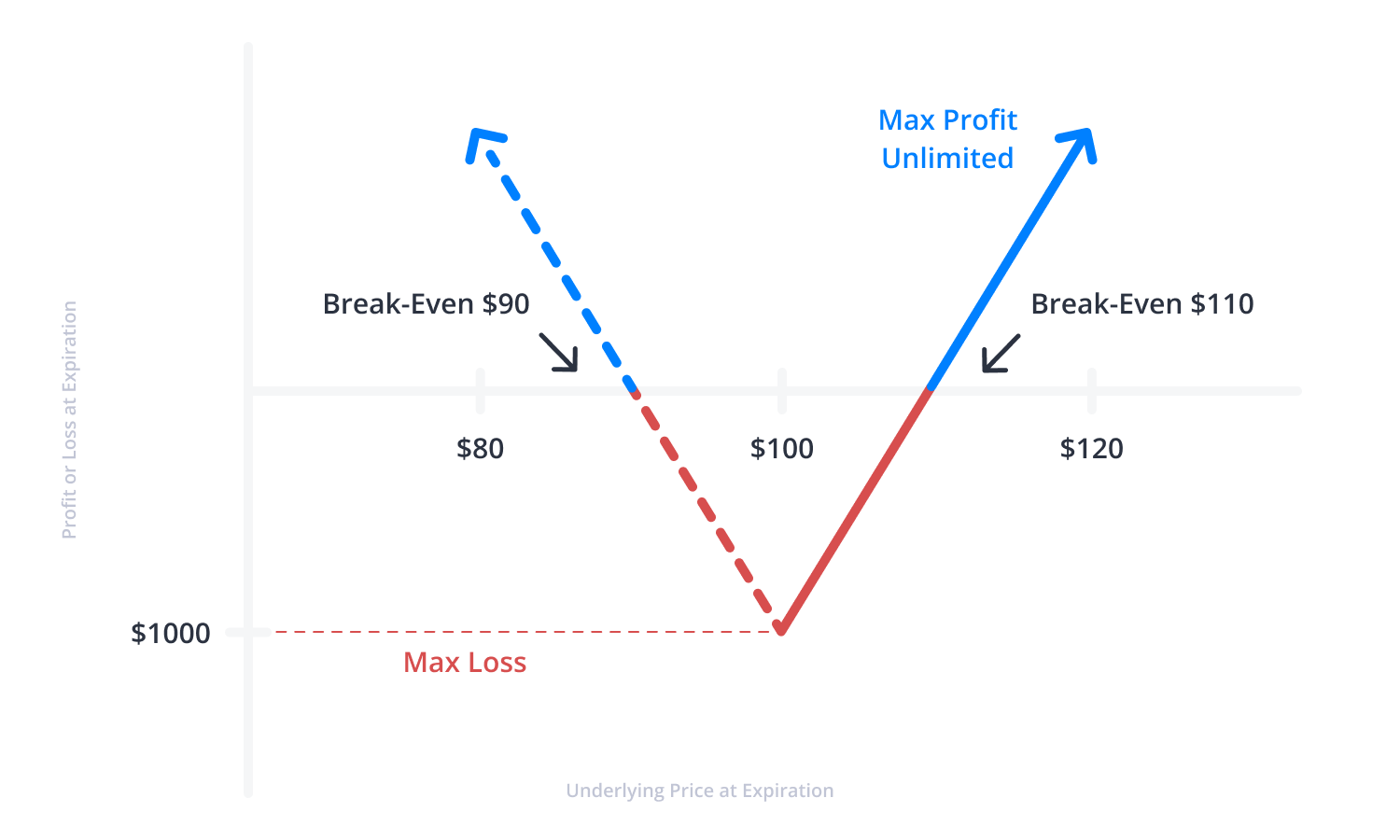

Hedging a Long Call

To hedge a long call, an investor may purchase a put with the same strike price and expiration date, thereby creating a long straddle. If the underlying stock price falls below the strike price, the put will experience a gain in value and help offset the loss of the long call. However, this adds cost to the original trade and widens the break-even price.

For example, if the original long call had a $5.00 debit, and a long put is purchased for an additional $5.00, the risk increases to $1,000 and the break-even points are extended.

-

Buy-to-open: $100 put

Synthetic Long Call

A synthetic long call combines long stock with a long put option at the entry price of the original long stock position. This creates a synthetic long call because the payoff diagram is similar to a single long call option. The maximum downside risk is limited to the long put option’s strike price, and the profit potential is unlimited if the stock continues to rise.

FAQs

What is a call option?

A long call is a risk-defined, bullish options strategy. Buying a call option is an alternative to buying shares of stock or an ETF. Long call options give the buyer the right, but no obligation, to purchase shares of the underlying asset at the strike price on or before expiration. A long call option contract is equivalent to owning 100 shares of stock, but requires less capital to purchase. The maximum risk is limited to the contract’s premium.

How do call options work?

Call options are a levered alternative to buying stock or ETF shares. One call option contract controls 100 shares of stock. Holding a call option contract gives you the right to buy shares at the contract's strike price. Writing a call option obligates you to sell shares at the cotract's strike price.

How to exercise a call option?

Exercising a call option gives you the right to own 100 shares per contract at the option's strike price. For example, if you exercise a call option with a $50 strike price, you will purchase 100 shares at $50, regardless of the underlying's price. You must have enough funds in your account to take ownership of the stock. Contact your broker for exercise instructions.

How to calculate long call option profit?

Long calls have unlimited profit potential. A long call option must be above the break even price at expiration to realize a profit. To calculate a long call option's break even price, add the contract's premium to the option's strike price. The option's cost is the max loss for the position.