Bear Call Credit Spread overview

Bear call spreads, also known as short call spreads, are credit spreads that consist of selling a call option and purchasing a call option at a higher price. The strategy looks to take advantage of a decline in price from the underlying asset before expiration. Time decay and decreased implied volatility will also benefit the bear call credit spread.

Bear Call Credit Spread market outlook

A bear call credit spread is entered when the seller believes the price of the underlying asset will be below the short call option’s strike price on or before the expiration date. Bear call spreads are also known as call credit spreads because they collect a credit when the trade is entered. The risk is limited to the width of the spread minus the credit received. The break-even price for the bear call credit spread is the short strike price plus the net credit received. Time decay and decreased implied volatility will also help the position become profitable. The closer the short strike price is to the underlying’s price, the more credit will be received at trade entry.

How to set up a Bear Call Credit Spread

A bear call credit spread is made up of a short call option with a long call option purchased at a higher strike price. The credit received is the maximum potential profit for the trade. The maximum risk is the width of the spread minus the credit received. The closer the strike prices are to the underlying’s price, the more credit will be collected, but the probability is higher that the option will finish in-the-money. The larger the width of the spread between the short option and the long option, the more premium will be collected. The outlook is more aggressive and the maximum risk will be higher.

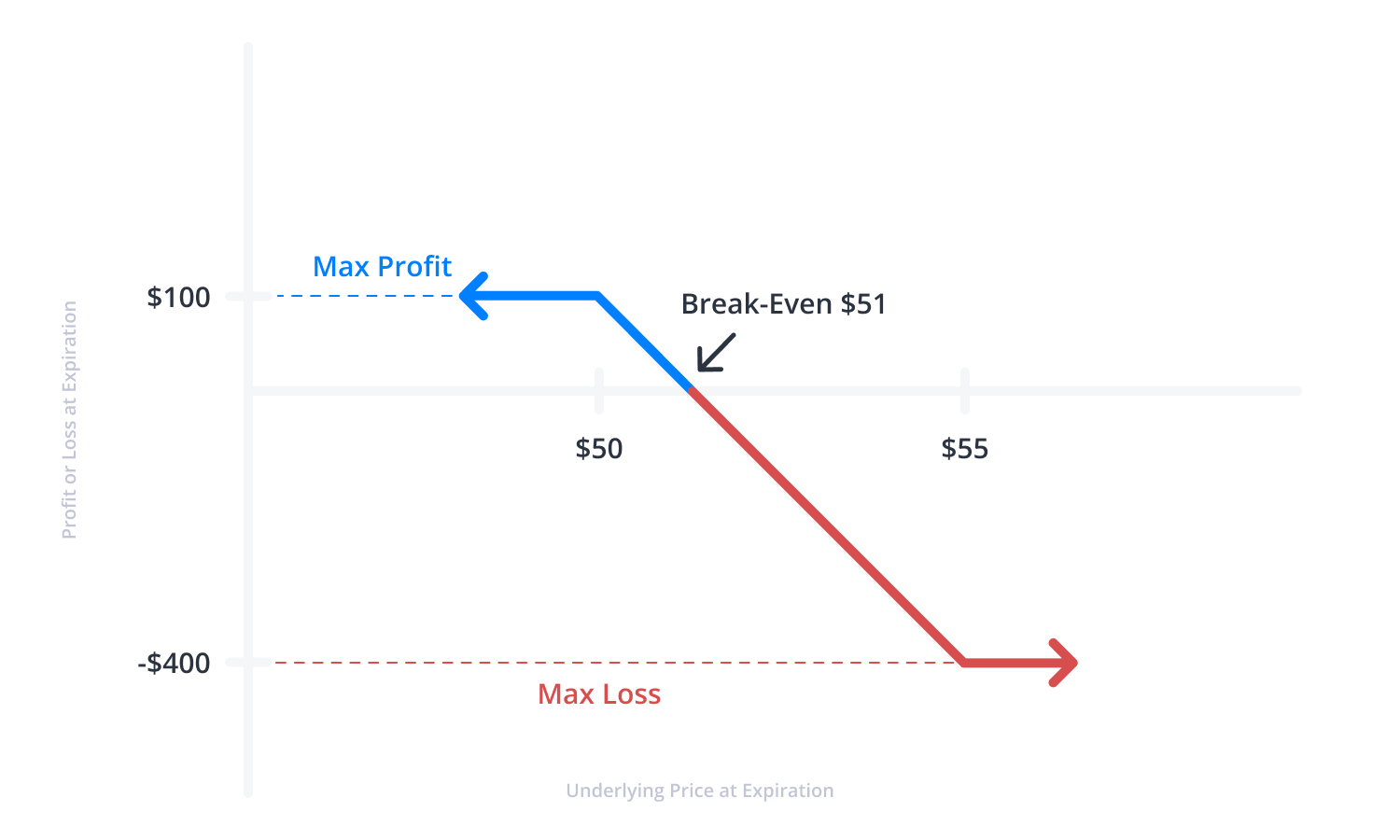

Bear Call Credit Spread payoff diagram

The bear call credit spread payoff diagram clearly outlines the defined risk and reward of credit spreads. Bear call spreads collect a credit when entered. The credit received is the maximum potential profit for the trade. Because long options are purchased for protection, the maximum risk is limited to the width of the spread minus the credit received.

For example, if a $5 wide bear call spread collects $1.00 of credit, the maximum gain is $100 if the stock price is below the short call at expiration. The maximum loss is $400 if the stock price is above the long call at expiration. The break-even point would be the short call strike plus the premium received.

Entering a Bear Call Credit Spread

A bear call spread consists of selling-to-open (STO) a call option and buying-to-open (BTO) a call option at a higher strike price, with the same expiration date. This will result in a credit received. Buying the higher call option will reduce the overall premium collected to enter the trade but will define the position's risk to the width of the spread minus the credit received.

For example, if an investor believes a stock will be below $50 at expiration, they could sell a $50 call option and buy a $55 call option. If this results in a $1.00 credit, the maximum profit potential is $100 if the stock closes below $50 at expiration, and the maximum loss is $400 if the stock closes above $55 at expiration.

-

Sell-to-open: $50 call

-

Buy-to-open: $55 call

The closer to the underlying stock price the spread is sold, the more bearish the bias.

Exiting a Bear Call Credit Spread

A bear call credit spread is exited by buying-to-close (BTC) the short call option and selling-to-close (STC) the long call option. If the spread is purchased for less than it was sold, a profit will be realized. If the stock price is below the short call option at expiration, both options will expire worthless, and the entire credit will be realized as profit. If the stock price is above the long call option at expiration, the two contracts will offset, and the position will be closed for the maximum loss.

For example, if a bear call credit spread is opened with a $50 short call and a $55 long call, and the underlying stock price is above $55 at expiration, the broker will automatically sell shares at $50 and buy shares at $55. If the stock price is between the two call options at expiration, the short option will be in-the-money and need to be repurchased to avoid assignment.

Time decay impact on a Bear Call Credit Spread

Time decay, or theta, works to the advantage of the bear call credit spread strategy. Every day the time value of an options contract decreases. Theta will exponentially lose value as the options approach expiration. The decline in value may allow the investor to purchase the options for less money than initially sold, even if a significant drop in price does not occur.

Implied volatility impact on a Bear Call Credit Spread

Bear call credit spreads benefit from a decrease in the value of implied volatility. Lower implied volatility results in lower option premium prices. Ideally, when a bear call credit spread is initiated, implied volatility is higher than it is at exit or expiration. Future volatility, or vega, is uncertain and unpredictable. Still, it is good to know how volatility will affect the pricing of the options contracts.

Adjusting a Bear Call Credit Spread

Bear call spreads can be adjusted if the underlying stock price has moved up and the position is challenged. An investor has two choices to maximize the probability of success as the position approaches expiration.

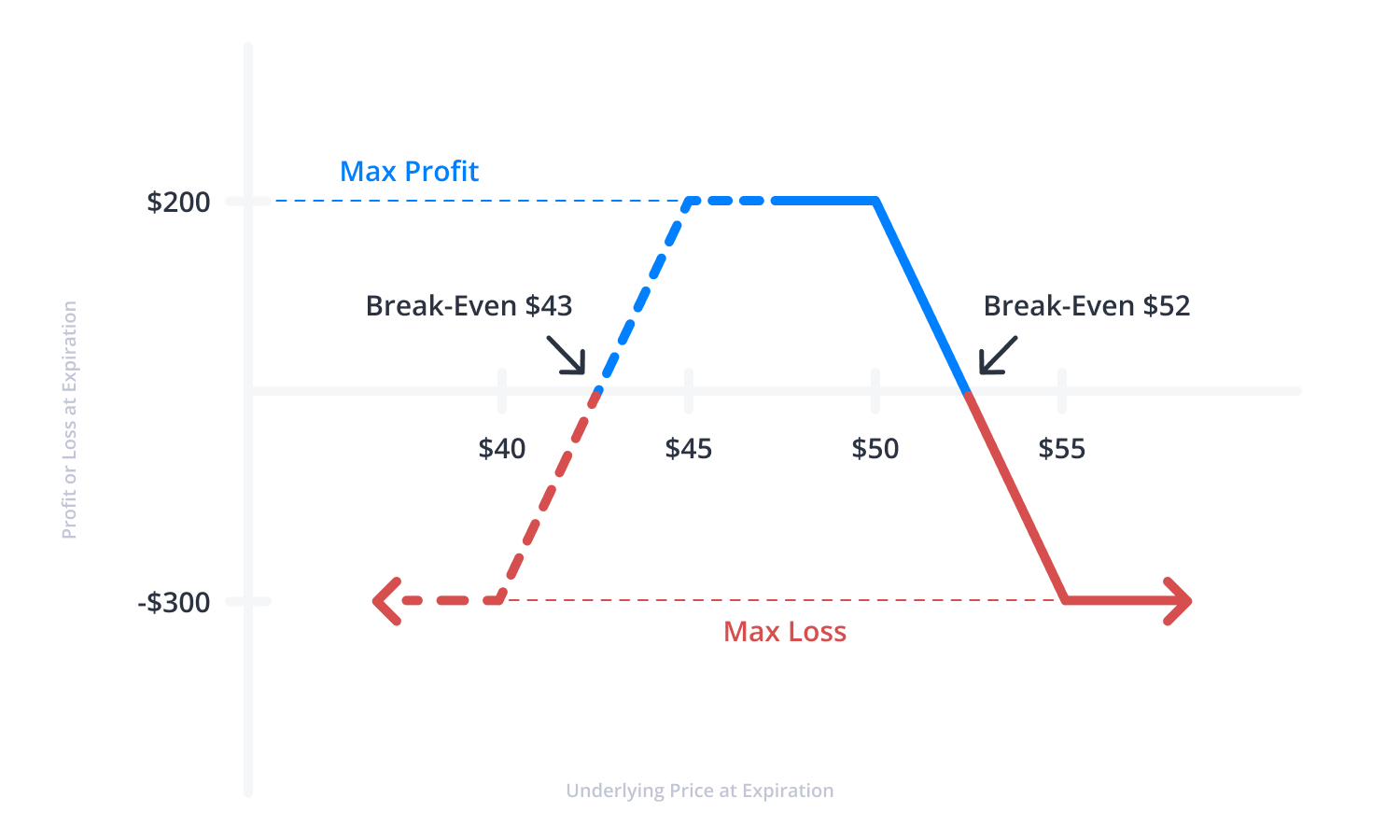

If the stock price has increased, an opposing bull put credit spread can be opened below the call spread to create an iron condor. Additional credit will be received and no additional risk will be added to the position if the spread width and number of contracts remain the same.

For example, if a $45 / $40 put credit spread is added to the original position and collects $1.00 of premium, the break-even point will be extended up and give the position a higher probability of profit while reducing risk. However, if the stock reverses, the bull put spread could become challenged.

-

Sell-to-open: $45 put

-

Buy-to-open: $40 put

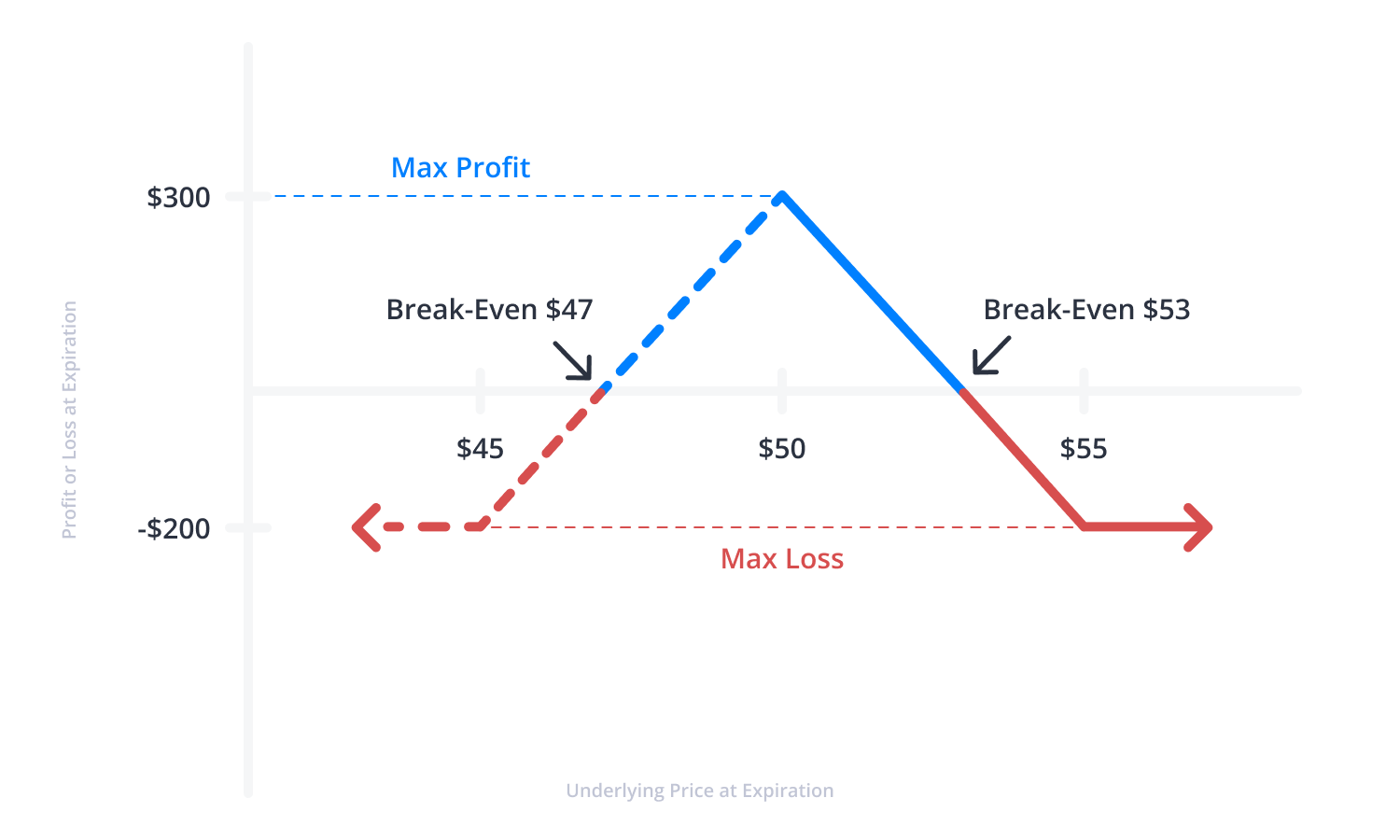

If the stock price has increased substantially and the short option is in-the-money, an opposing bull put credit spread can be opened with the same strike price and expiration date as the call spread. This will create an iron butterfly. Additional credit will be received and no additional risk will be added to the position if the spread width and number of contracts remain the same. A credit spread adjusted to an iron butterfly will have more profit potential and less risk than an iron condor, but the position’s range of profitability ($47 - $53) is smaller than an iron condor.

For example, if a put credit spread centered at the same $50 strike price collects an additional $2.00 of credit, the break-even point will be extended up and give the position a higher probability of profit while reducing risk. However, if the stock reverses, the bull put spread could become challenged.

-

Sell-to-open: $50 put

-

Buy-to-open: $45 put

Rolling a Bear Call Credit Spread

Bear call spreads can be rolled out to a later expiration date to extend the duration of the trade. Rolling the position for a credit reduces risk and extends the break-even point. To roll the position, purchase the existing bear call credit spread and sell a new spread with a later expiration date.

For example, if the original bear call spread has a June expiration date and received $1.00 of premium, an investor could buy-to-close (BTC) the entire spread and sell-to-open (STO) a new position with the same strikes in July. If this results in a $1.00 credit, the maximum profit potential increases by $100 per contract and the maximum loss decreases by $100 per contract. The new break-even price will be $52.

Hedging a Bear Call Credit Spread

Bear call credit spreads can be hedged to help minimize the position’s risk while increasing profit potential. If the stock price has moved up, an opposing bull put credit spread can be opened with the same spread width and expiration date as the bear call spread. This brings in additional credit while reducing the maximum risk. The new spread helps to offset the loss of the original position.

FAQs

What is a bear call credit spread?

A bear call credit spread (also known as a short call spread) is a risk-defined, bearish strategy with limited profit potential. Bear call spreads are credit spreads that consist of selling a call option and purchasing a call option at a higher strike price with the same expiration date. A bear call credit spread is opened when the seller believes the price of the underlying asset will be below the short call option’s strike price on or before the expiration date. Time decay and decreasing implied volatility will also benefit the bear call credit spread.

How do you close a bear call credit spread?

A bear call credit spread is exited by buying-to-close (BTC) the short call option and selling-to-close (STC) the long call option. If the spread is purchased for less than it was sold, a profit will be realized. If the stock price is below the short call option at expiration, both options will expire worthless, and the entire credit will be realized as profit. If the stock price is above the long call option at expiration, the two contracts will offset and the position will be closed. If the stock price is between the two call options at expiration, the short option will be in-the-money and need to be repurchased to avoid assignment.

How do you break-even on a short call spread?

To calculate a short call spread's break-even price, add the credit received to the position’s short call strike. For example, a bear call spread with a $50 short call option that collects $1.00 of credit has a break-even price is $51.

What is a short call spread?

A short call spread is a bearish strategy with limited profit potential and defined risk. Short call spreads benefit from theta decay and decreasing volatility.

How does a short call spread work?

To open a bearish short call spread, sell-to-open a call option and buy-to-open a call option at a higher strike price with the same expiration date and same number of contracts.