Bull Call Debit Spread overview

Bull call spreads, also known as long call spreads, are debit spreads that consist of buying a call option and selling a call option at a higher price. The strategy looks to take advantage of a price increase from the underlying asset before expiration. Increased implied volatility may also benefit the bull call debit spread.

Bull Call Debit Spread market outlook

A bull call debit spread is entered when the buyer believes the underlying asset price will increase before the expiration date. Bull call spreads are also known as call debit spreads because they require paying a debit at trade entry. Risk is limited to the debit paid at entry. The further out-of-the-money the bull call debit spread is initiated, the more aggressive the outlook.

How to set up a Bull Call Debit Spread

A bull call debit spread is made up of a long call option with a short call option sold at a higher strike price. The debit paid is the maximum risk for the trade. The maximum profit potential is the spread width minus the premium paid. To break even on the position, the stock price must be above the long call option by at least the cost to enter the position.

The closer the strike prices are to the underlying’s price, the more debit will be paid, but the probability is higher that the option will finish in-the-money. The larger the spread width between the long call and the short short, the more premium will be paid, and the maximum potential profit will be higher.

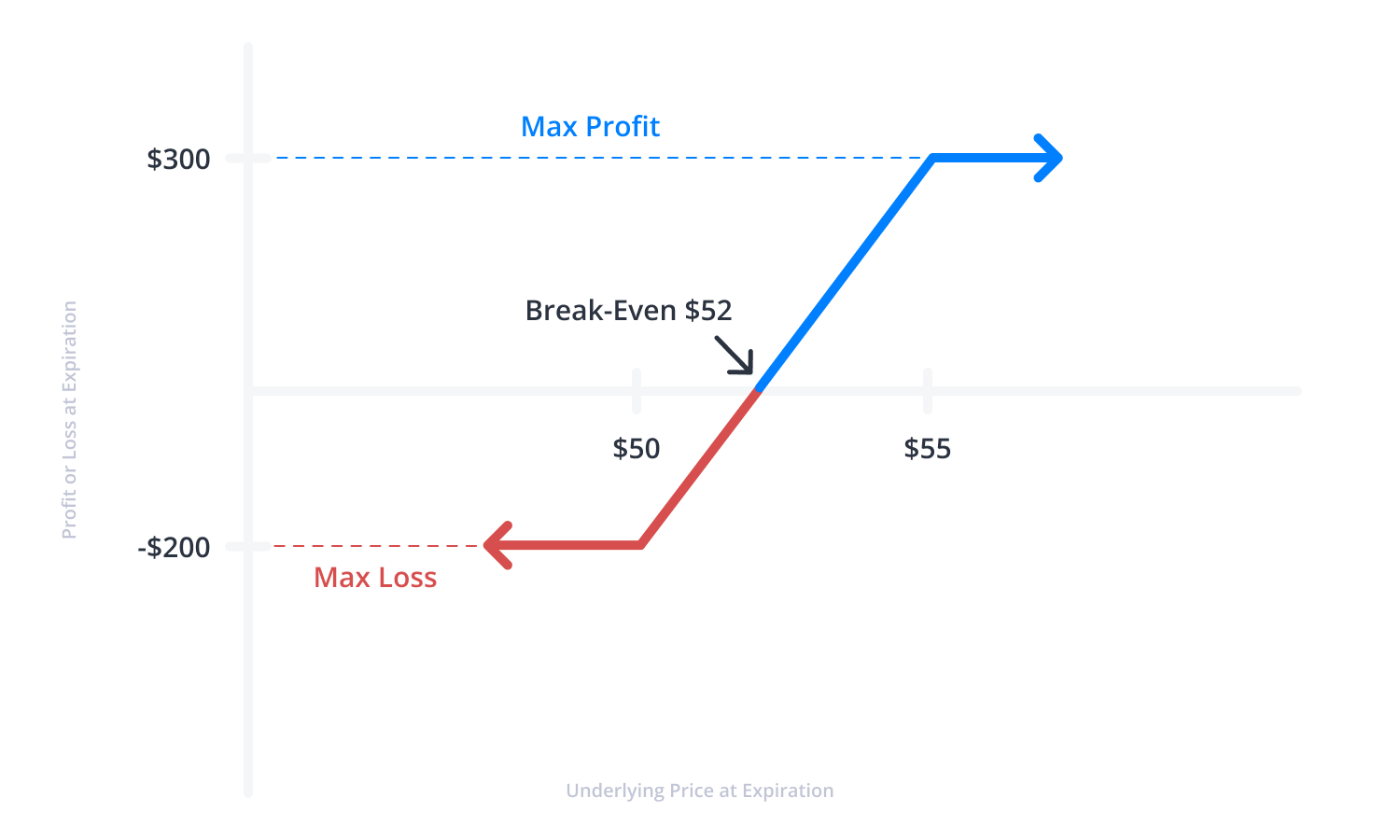

Bull Call Debit Spread payoff diagram

The bull call spread payoff diagram clearly outlines the defined risk and reward of debit spreads. Bull call spreads require a debit when entered. The debit paid is the maximum potential loss for the trade. Because a short option is sold to reduce the trade's cost basis, the maximum profit potential is limited to the spread width minus the debit paid.

For example, if a $5 wide bull call debit spread costs $2.00, the maximum profit is $300 if the stock price is above the short call at expiration, and the maximum loss is $200 if the stock price is below the long call at expiration. The break-even point would be the long call strike plus the premium paid.

Entering a Bull Call Debit Spread

A bull call spread consists of buying-to-open (BTO) a call option and selling-to-open (STO) a call option at a higher strike price, with the same expiration date. This will result in paying a debit. Selling the higher call option will help reduce the overall cost to enter the trade and define the risk while limiting the profit potential.

For example, an investor could buy a $50 call option and sell a $55 call option. If the spread costs $2.00, the maximum loss possible is -$200 if the stock closes below $50 at expiration. The maximum profit is $300 if the stock closes above $55 at expiration. The break-even point would be $52.

-

Sell-to-open: $50 call

-

Buy-to-open: $55 call

Bull call debit spreads can be entered at any strike price relative to the underlying asset. In-the-money options will be more expensive than out-of-the-money options. The further out-of-the-money the spread is purchased, the more bullish the bias.

Exiting a Bull Call Debit Spread

A bull call spread is exited by selling-to-close (STC) the long call option and buying-to-close (BTC) the short call option. If the spread is sold for more than it was purchased, a profit will be realized. If the stock price is above the short call option at expiration, the two contracts will offset, and the position will be closed for a full profit.

For example, if a call debit spread is opened with a $50 long call and a $55 short call, and the underlying stock price is above $55 at expiration, the broker will automatically buy shares at $50 and sell shares at $55. If the stock price is below the long call option at expiration, both options will expire worthless, and the full loss of the original debit paid will be realized.

Time decay impact on a Bull Call Debit Spread

Time decay, or theta, works against the bull call debit spread. The time value of the long option contract decreases exponentially every day. Ideally, a large move up in the underlying stock price occurs quickly, and an investor can capitalize on all the remaining extrinsic time value by exiting the position.

Implied volatility impact on a Bull Call Debit Spread

Bull call debit spreads benefit from an increase in the value of implied volatility. Higher implied volatility results in higher options premium prices. Ideally, when a bull call debit spread is initiated, implied volatility is lower than it is at exit or expiration. Future volatility, or vega, is uncertain and unpredictable. Still, it is good to know how volatility will affect the pricing of the options contracts.

Adjusting a Bull Call Debit Spread

Bull call debit spreads have a finite amount of time to be profitable and have multiple factors working against their success. If the underlying stock does not move far enough, fast enough, or volatility decreases, the spread will lose value rapidly and result in a loss. Bull call spreads can be adjusted like most options strategies but will almost always come at more cost and, therefore, add risk to the trade and extend the break-even point.

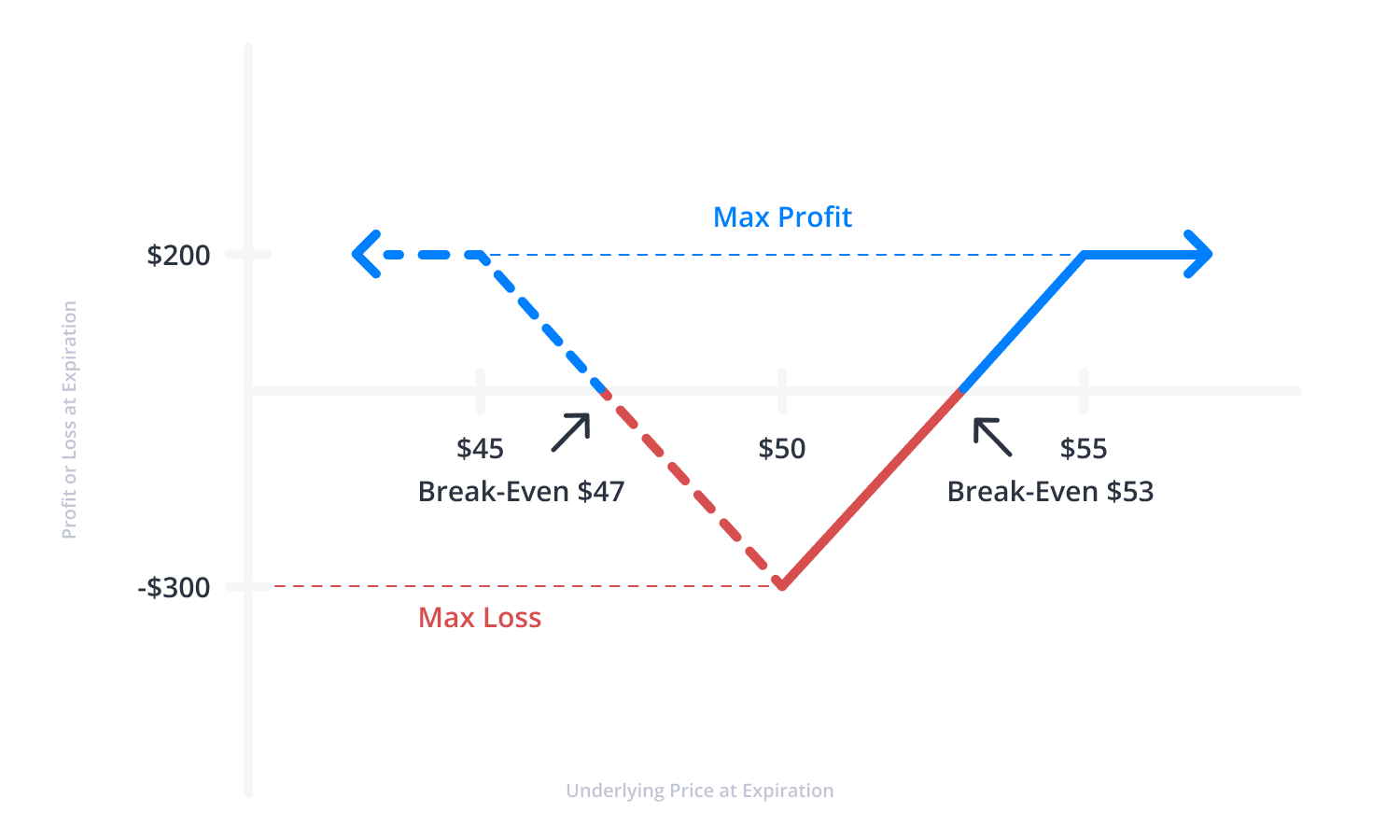

If the stock price has moved down, a bear put debit spread could be added at the same strike price and expiration as the bull call spread. This creates a reverse iron butterfly and allows the put spread to profit if the underlying price continues to decrease. However, the additional debit spread will cost money and extend the break-even point.

For example, if a $5 wide put debit spread centered at the same $50 strike price costs $1.00, an additional $100 of risk is added to the trade, and the profit potential decreases by $100.

-

Sell-to-open: $50 put

-

Buy-to-open: $45 put

Rolling a Bull Call Debit Spread

Bull call debit spreads can be rolled out to a later expiration date if the underlying stock price has not moved enough. To roll the position, sell the existing bull call spread and purchase a new spread at a later expiration date. This requires paying another debit and will increase the risk, but will extend the duration of the trade.

For example, if the original bull call spread has a March expiration date and cost $2.00, an investor could sell-to-close (STC) the entire spread and buy-to-open (BTO) a new position in April. If this results in a $1.00 debit, the maximum profit potential decreases by $100 per contract and the maximum loss increases by $100 per contract. The new break-even price will be $53.

Hedging a Bull Call Debit Spread

Bull call debit spreads can be hedged if the underlying stock's price has decreased. To hedge the bull call spread, purchase a bear put debit spread at the same strike price and expiration as the bull call spread. This would create a long butterfly and allow the position to profit if the underlying price continues to decline. The additional debit spread will cost money and extend the break-even points.

FAQs

What is a bull debit spread?

A bull debit spread is a bullish strategy with limited profit potential and defined risk. The strategy consists of buying a call option and selling a call option with the same expiration date at a higher strike price.

Is a call debit spread bullish or bearish?

Call debit spreads are bullish and also known as bull call spreads. Call debit spreads benefit when the underlying security's price increases.

What is an example of a call debit spread?

A bull call spread consists of buying-to-open (BTO) a call option and selling-to-open (STO) a call option at a higher strike price, with the same expiration date. This will result in paying a debit. Selling the higher call option will help reduce the overall cost to enter the trade and define the risk while limiting the profit potential. For example, an investor could buy a $50 call option and sell a $55 call option. If the spread costs $2.00, the maximum loss possible is -$200 if the stock closes below $50 at expiration. The maximum profit is $300 if the stock closes above $55 at expiration. The break-even point would be $52.

Are debit spreads risky?

Call debit spreads and put debit spreads have defined risk. The premium paid to open the position is the max potential loss. To realize a max loss, the underlying price must be below the long call option at expiration. Profit potential is limited for debit spreads. A bull debit spread's max profit is the spread's width minus the premium paid. To realize the max profit, the underlying price must be above the short call option at expiration.